INVESTORS SEEKING COMPETITIVE INVESTMENT LOAN RATES & PORTFOLIO SUPPORT

Smarter borrowing!

Astute investors don’t leave things to chance.

Take control of your property portfolio with

cost saving investment loan rates

Uncertain Where To Secure The Smart Money To Grow Your Property Portfolio At Competitive Rates...Without Chewing Up Your Precious Time?

Savvy investors… Are you looking to grow your portfolio and minimize risk? We get it - smart investing takes research and financial support. And with a turbulent stock market and high rental demand, it's no wonder many investors are turning to real estate. But securing profitable properties and the right loan can be a challenge, especially in the tightening financial markets.

That's where we fit in, providing insights and finance options to help you solidify your portfolio and achieve your investment goals. Our team has a reputation for securing smart money for even the most challenging transactions, and we won't stop fighting until we've found the optimal outcomes for your property finance.

With our help, you can trust that we'll find the right lender and loan for your needs, leaving you more time to focus on finding your ideal property. So why wait? Let's work together to make your investment goals a reality.

Planning

Response

Support

How Leonard Secured Top Investment Properties… With Our Support!

Leonard, who originally came from Zimbabwe, faced challenges in investing in property when he arrived in Australia. He identified some investment opportunities in the North Brisbane region, even though he lived and worked in Toowoomba. He sought finance working with QMP Financial and appreciated the guidance and education in navigating the complex process of investing in a new country.

As someone with a busy schedule, Leonard valued having mortgage broking experts on his side to help him make informed investment finance decisions and secure property on his terms. Overall, Leonard’s experience shows the importance of seeking expert advice when investing in property. With the right guidance and education, anyone can navigate the challenges of investing in property and make informed decisions to achieve their investment goals.

Want a hand to secure your next investment property… or perhaps you’re looking to consolidate your finance across your current property portfolio? If the answer is ‘Yes’, click now to fast-track your investment journey…

Investment Repayment Return Calculator

WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate

How Kristi & Ryan Leveraged Smarter Borrowing To Grow Their Investment Portfolio

Kristi and Ryan wanted to move from their unit to a house and were able to release equity to help with the purchase. They were strategic in their approach to homeownership. By releasing equity from their previous property, they were able to put more money towards their house purchase and get into a larger home that better suited their needs.

After moving in, they continued to keep an eye on the value of their home. When a refinance opportunity presented itself, they were able to release additional equity to complete some renovation works on the property. This not only made the house more comfortable to live in, but also added value to the property, which could potentially benefit them in the future should they decide to sell.

Are you interested in learning whether you can unlock equity in your property by refinancing… or perhaps you’re looking to take control and secure savings on your mortgage repayments? If’ the answer is ‘Yes’, click here to get started…

Property Investors Seeking The Lowest Loan Rates

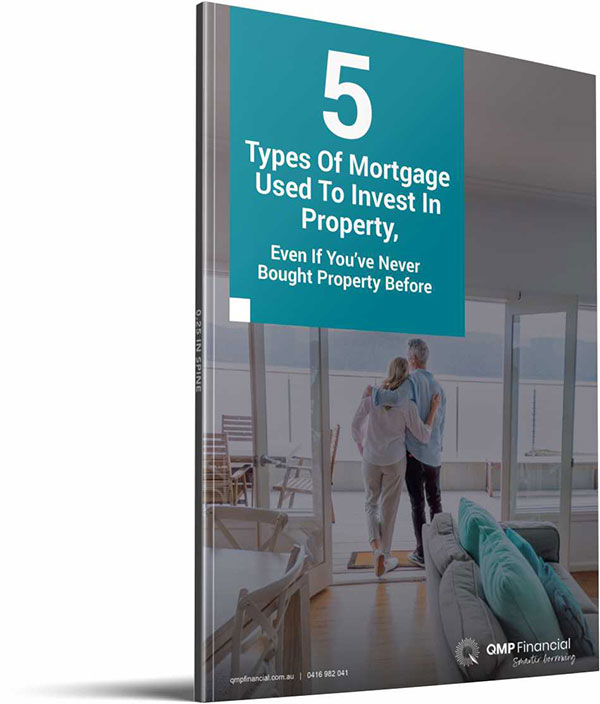

The 5 Types Of Mortgage Used To Invest In Property, Even If You’ve Never Invested Before!

Not all loans are the same for investing. Learn the differentiation between these investment loans and the process for putting yourself in the box seat for securing funding for your next investment property...

*Your Privacy is 100% safe with us. When you enquire you confirm you have read & agree with our

What Smart Property Buyers Say About QMP Financial...

Hiranthi Thambugala

3 reviews

Pete has been a great helping me with my finances. I have a more positive outlook on my future after his advice. Looking forward to working with him in the future!

Suz D

27 reviews

Great experience and highly

recommend their services. Pete

was a pleasure to deal with. I

always felt in good hands

Joshua Rowe

1 reviews

Pete was professional and hard working. I appreciate all the help in achieving finance and hope to collaborate more in the future. Cheers

Hiranthi Thambugala

3 reviews

Pete has been a great helping me with my finances. I have a more positive outlook on my future after his advice. Looking forward to working with him in the future!

Suz D

27 reviews

Great experience and highly

recommend their services. Pete

was a pleasure to deal with. I

always felt in good hands

Joshua Rowe

1 reviews

Pete was professional and hard working. I appreciate all the help in achieving finance and hope to collaborate more in the future. Cheers

Proven Lending Partner Network

Real help for Investors!

FAQ

Australians are among the most active property investors in the world, with an average of one in every three new mortgages each month arranged for investors. Most of these investors are ordinary people with ordinary jobs earning ordinary incomes. So, why is property investment so popular?

Capital growth is the increase in value of property over time and the long term average growth rate for Australian residential property is about 9% a year. Importantly, because property markets move in cycles, property values go through periods of stagnation as well as decline. This is why taking an investment view of at least 10 years is important. Note: if your investment property increases by 7.5% a year, over a 10 year period it will double in value.

Rental income, also known as yield, is the rent an investment property generates. You can calculate this by dividing the annual rent by the price paid for the property and multiplying it by 100 to produce a percentage figure. As a general rule, more expensive properties generate lower yields than more moderately priced properties. There is also usually a direct, inverse relationship between capital growth and rental income. Those properties producing a lower rental yield will often deliver greater capital growth over the long term.

The Federal Government allows you to offset against your taxable income any losses you incur from owning an investment property. For example, if the amount you receive in rent from tenants is $5,000 less than the cost of servicing the mortgage, and paying rates, water and other fees associated with the property, at the end of the year you can add that $5,000 to the amount of income on which you don’t have to pay tax. If you work as an employee, with income tax automatically deducted from your pay, this means you’ll receive a refund from the Australian Taxation Office (ATO) after the end of the financial year.

Property values generally fluctuate less than the stock market. Many investors say they experience greater peace of mind for this reason.

Property enables far greater leverage than many other investments. For example, if you have $100,000 in savings, you could invest it in a portfolio of shares, or use it to buy a property worth $500,000 by taking out a mortgage for $400,000. If shares go up by 10% during the year, your share portfolio would be worth $110,000 and you would have gained $10,000. If property goes up by 10% during that same year, your property would be worth $550,000 and you would have gained $50,000.

You don’t need a big salary to invest. If you are buying to invest, lenders will take rental income as well as your own income into their assessment. If you already own your own home and have some equity in it, you may be able to use this as a deposit, meaning that you can buy an investment property without having to find any additional cash. If you don’t own your own home and feel you may never be able to afford one, buying an investment property may be a good stepping stone to one day being able to afford your own home.

We’re all unique when it comes to our finances and borrowing needs. Get an estimate on how much you could borrow with our Home Loan Quote in 30 seconds. Or contact us today, we can help with calculations based on your circumstances.

Our guides to loan types and features will help you learn about the main options available. There are hundreds of different home loans available, so talk to us today.

Usually between 5% – 10% of the value of a property, which you pay when signing a Contract of Sale. Speak with us to discuss your options for a deposit. You may be able to borrow against the equity in your existing home or an investment property.

Go to our Repayment Calculator for an estimate. Because there so many different loan products, some with lower introductory rates, talk to us today about the deals currently available, we’ll find the right loan set-up for you.

Most lenders offer flexible repayment options to suit your pay cycle. Aim for weekly or fortnightly repayments, instead of monthly, as you will make more payments in a year, which will shave dollars and time off your loan.

There are a number of fees involved when buying a property. To avoid any surprises, the list below sets out all of the usual costs:

- Stamp Duty — This is the big one. All other costs are relatively small by comparison. Stamp duty rates vary between state and territory governments and also depend on the value of the property you buy. You may also have to pay stamp duty on the mortgage itself. To find out your total Stamp Duty charge, visit our Stamp Duty Calculator.

- Legal/conveyancing fees — Generally around $1,000 – $1500, these fees cover all the legal rigour around your property purchase, including title searches.

- Building inspection — This should be carried out by a qualified expert, such as a structural engineer, before you purchase the property. Your Contract of Sale should be subject to the building inspection, so if there are any structural problems you have the option to withdraw from the purchase without any significant financial penalties. A building inspection and report can cost up to $1,000, depending on the size of the property. Your conveyancer will usually arrange this inspection, and you will usually pay for it as part of their total invoice at settlement (in addition to the conveyancing fees).

- Pest inspection — Also to be carried out before purchase to ensure the property is free of problems, such as white ants. Your Contract of Sale should be subject to the pest inspection, so if any unwanted crawlies are found you may have the option to withdraw from the purchase without any significant financial penalties. Allow up to $500 depending on the size of the property. Your real estate agent or conveyancer may arrange this inspection, and you will usually pay for it as part of their total invoice at settlement (in addition to the conveyancing fees).

- Lender costs — Most lenders charge establishment fees to help cover the costs of their own valuation as well as administration fees. We will let you know what your lender charges but allow about $600 to $800.

- Moving costs — Don’t forget to factor in the cost of a removalist if you plan on using one.

- Mortgage Insurance costs — If you borrow more than 80% of the purchase price of the property, you’ll also need to pay Lender Mortgage Insurance. You may also choose to take out Mortgage Protection Insurance. If you buy a strata title, regular strata fees are payable.

- Ongoing costs — You will need to include council and water rates along with regular loan repayments. It is important to also take out building insurance and contents insurance. Your lender will probably require a minimum sum insured for the building to cover the loan, but make sure you actually take out enough building insurance to cover what it would cost if you had to rebuild. Likewise, make sure you have enough contents cover should you need to replace everything if the worst happens. and contents insurance. Your lender will probably require a minimum sum insured for the building to cover the loan.

Fast-track Your Finance

What You’ll Discover In Your FREE Tailored Home Finance Fast-track Session

Don’t leave your property finance to chance. Book your FREE Tailored Home Finance Fast-track Session today and discover the keys to securing your property of choice! Our professional mortgage brokers will help you explore your critical requirements for securing finance quickly, including strategies to minimise repayments, the loan options that best suit your needs, and your borrowing capacity. You’ll also learn how to see the credit rating the banks are judging you by, and how to fast-track your property finance process.

During the session, you’ll get your most pressing loan questions answered by our experts, ensuring that you have all the information you need to make informed decisions about your finances. And best of all, there’s no risk or obligation to do anything following your session – just pure upside for you from day one! Book your session now and take the first step towards fast-tracking your property purchase.

*These sessions are strictly limited, so reach out now to avoid disappointment

Secure Your FREE Tailored Home Finance Fast-track Session Now

*No cost and no obligation...Just support. Your Privacy is 100% safe with us. When you enquire you confirm you have read & agree with our

Fast-track Your Finance... That’s Our Promise!

We understand that the banks can be hard to deal with, especially if you haven’t caught up with lenders’ current requirements!

That’s why we promise to help you fast-track your finance… So you can make informed decisions sooner. We guide you through the step-by-step process on your journey to securing your property of choice, stress-free!

You’re invited to learn the facts you need to know now to secure finance! It sure beats leaving it to chance, setting yourself up for failure or wasting your time. It’s the key to fast-tracking property ownership (or re-finance)!

Want to fast-track your finance…?

*QMP Financial employs systems and strategies to accelerate the collection of customer information, assessment of eligibility and presentation of loan options, with the goal of helping clients fast-track their finance applications. This promise is not a guarantee that any given lender will approve a loan for our clients, nor that QMP Financial is responsible for the turn-around time of the lender once the required information is provided to the lender.

Don’t let the opportunity pass you by...

We hold your hand to simplify the steps to securing property finance, so you can understand, prepare for and fast-track securing home ownership, without making mistakes that could otherwise cost you thousands! Share your details to secure a private call back...

*No cost and no obligation...Just support. Your Privacy is 100% safe with us. When you enquire you confirm you have read & agree with our