In the aftermath of a turbulent year in the finance and property sector, many individuals may be feeling hesitant and uncertain about the future. Whether you are a first-time homebuyer or a seasoned investor, you might wonder if it’s a favorable moment to venture into the property market.

With a myriad of conflicting opinions about the coming years, self-proclaimed “experts” are plentiful, offering guidance on managing finances, mortgages, property transactions, savings, and investments.

In April, some signs suggested that the property market might be undergoing a shift. Several major cities experienced a slight but positive growth for the first time in a year, and the cash rate was stable for the first time in 11 months.

As for speculations on interest rates, inflation, and property prices this year, there remains little certainty and consistency among economists and industry experts. However, some noteworthy points include:

- Inflation is anticipated to stabilize and possibly decrease later this year.

- The cash rate and subsequently interest rates are likely to follow this trend, with CBA predicting the first rate cut to occur in the last quarter of the year.

- Australia’s population growth is booming, driven by a record high net overseas migration intake and stable natural increase.

- The supply of housing is limited, which might not be sufficient to accommodate the growing demand.

- Rental accommodation costs remain high, with an expected 11.5% increase in rents this year, in addition to the recorded 10% increase last year (according to Westpac).

In February 2023, PEXA released the first of three white papers, which found “little evidence that interest rates are the sole driver of house prices over the long term, with price growth strong and consistent over 50 years regardless of whether long-term interest rates were high or low.”

So, what does this mean for investors?

Warren Buffet serves as an excellent role model in comprehending the cyclical pattern of the economy and investment markets. Rather than succumbing to panic during market downturns, he capitalizes on such situations using his education and expertise.

“The investor of today does not profit from yesterday’s growth.” – Warren Buffet

The problem with purchasing a property solely for capital growth is that we don’t possess a property crystal ball.

Two common drivers typically influence decisions about property purchases, and often, other purchases as well:

- FOMO – Fear of Missing Out: The temptation to buy arises when others are buying to avoid missing out. However, following the herd and jumping on the property bandwagon may not be wise, as it could coincide with the market nearing its peak.

- FOBE – Fear of Buying Early: On the other hand, the fear of buying too early, with the possibility of property values falling after the purchase, holds some individuals back.

Contrary to FOMO, purchasing during a buyers’ market when demand is lower may offer a better chance of securing a favorable deal.

While timing the property market is not the ultimate solution, understanding its cyclical nature can be beneficial.

As Warren Buffet famously advised: “Be fearful when others are greedy and be greedy when others are fearful.”

Amidst the constant bombardment of property and finance news in the media, it can be challenging not to get swept up in the emotional rollercoaster. While emotions have their place in everyday life, they should not be the driving force behind investment decisions.

Another piece of wisdom from Mr. Buffet when it comes to buying property is: “Only buy something you’d be perfectly happy to hold if the market shut down for 10 years.”

And this one – “Our favorite holding period is forever.”

Now, what about the long-term trend of housing prices in Australia?

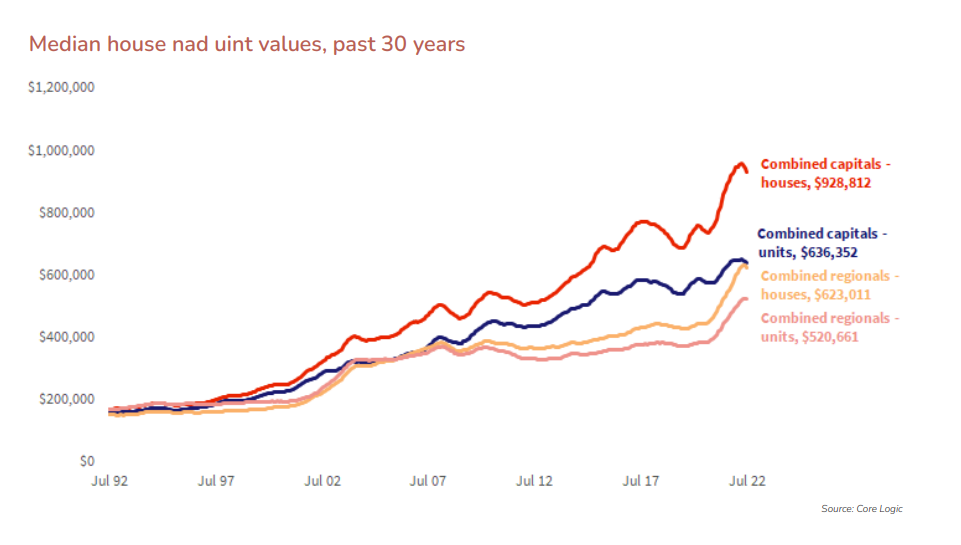

While housing values go through cycles of growth and declines, the undeniable long-term trend is upwards. Nationally, dwelling values have increased by 382% over the past 30 years, rising by an average of 5.4% annually in compounding terms since July 1992.

Although we cannot definitively recommend whether you should purchase an investment property or if NOW is the right time, we can assist you in being prepared when you feel the time is right for you. Here’s how we can help:

- Determine your house’s current value.

- Assess the equity you have available for purchasing another property (or if you don’t own a property yet, determine your potential deposit).

- Calculate your borrowing capacity and serviceability.

- Connect you with specialists in the property industry to find a suitable property for purchase.

The first step is to pick up the phone and schedule a time with us to start the conversation. We would love to explore your options with your best interests in mind.